Billing is hard. If you’ve ever had a customer suspended by mistake or spent hours fixing mismatched invoices, you know exactly what that means. Because billing is so interconnected with operations and business support systems (OSS/BSS), every move counts – and it can go belly-up quickly if something breaks.

Choosing the right ISP Billing System in 2025 isn’t about patching things with clever workarounds – that’s a trap you could quickly get into. Workarounds seem cost-effective (and sometimes faster) until your techs chase ghost errors or customers get double-billed.

If you’re tired of spreadsheets, late payments, chasing down disconnected accounts, double charges, or angry support tickets, this post is for you.

In the next few minutes, we’ll walk through 4 main steps to future-proof your billing, so you can scale without chaos.

Update on June 26, 2025: Continuing our efforts to automate repetitive, time-wasting billing tasks and get paid more easily, we’re updating our original article, incorporating new billing features from Splynx to make it easier than ever to run your ISP business. These features include instant invoice generation, automatic invoice charging, smart cancellation with refunds and more.

The ISP industry, especially wireless ISPs (WISPs), is steadily growing. Back in 2021, the Carmel Group shared that around 2,800 U.S.-based ISPs focused on fixed wireless served 6.9 million users. That number is expected to hit 12.7 million by the end of 2025. By 2023, WISPs were already reaching over 9 million Americans and still expanding their coverage, according to David Zumwalt, CEO of WISPA.

In the U.S., fixed wireless access (FWA) has also been leading the way in signing up new broadband users since 2022. Since 5G became more common, FWA has quickly gained even more market share.

This rise in subscribers brings more billing work and makes operations harder to manage manually. That’s why it’s so important nowadays to have a system that can grow with your business and handle many tasks automatically. ISPs that automate billing, customer care, and network tasks can free up their teams to focus on growth and better support, instead of getting stuck with routine admin jobs.

When evaluating billing software for your ISP or WISP business, consistently look for a core set of capabilities. Make sure any solution you consider checks off these common requirements:

Identify which requirements are “must-haves” for your specific business (e.g. do you need Inventory Management? Scheduling module + mobile app? ISP billing software + OLT SNMP management tool?) and use that to shortlist the right platform.

Beyond raw features, billing must advance your ISP business’s key priorities and goals. Here are the top priorities ISP/WISP owners typically consider, backed by real customer feedback of successful experience:

Many ISPs, mainly when they’re starting small in the beginning, focus more on enlarging the footprint of their business rather than administrating it. But I can guarantee everyone that you can never grow if you don’t create a solid ground for growth.

I actually think because of all the automation that Splynx does for us we’d probably be able to double our amount of customers and still kind of operate like we’re operating now.

A top priority is eliminating time-consuming manual tasks from your team’s plate. Consider activities like preparing invoices by hand, cross-checking payments, updating network devices when a plan changes, or compiling monthly revenue reports in spreadsheets. Automating these not only saves staff time but also reduces human errors.

The billing automation was a game changer – payment integration, disconnection, and reconnection – all handled seamlessly. No more losses from unpaid clients or 2 AM “I’ve paid, reconnect me” calls. We ditched manual reconciliation and disconnections, freeing us to focus on onboarding more and more customers.

AU Wireless, a community-focused ISP in Colorado, is another prominent example. Thanks to more automated billing and customer management, they achieved a 50% reduction in software costs. This shift reduced overhead and freed up their small team to focus on improving service delivery in underserved rural areas.

We actually try to be proactive and phone the clients and say, look, there’s an issue. We actually record and send them a little 2-minute video. We’re not browsing or not monitoring what they’re browsing. We don’t know what they’re doing, but we can see that DNS security issues are popping up. So do you want us to do AnyDesk quickly and just clean up what you have, or just bring your laptop or your device to the office and then we’ll have a look at it.

With Splynx, month-end billing went from days to an hour, streamlining operations. The time saved processing anything has improved across the board. We no longer miss tickets or non-billings to customers. Customers can now track their own accounts, view all the tickets, and pay online. The amount of support to our call center has dropped significantly.

When you can apply correct tax rates based on location, create detailed tax reports, and support built-in reporting formats required by government agencies. Ideally, data about users and coverage should be pulled into reports automatically, cutting down on manual steps and mistakes. While PCI-DSS rules don’t apply to all ISPs, they are important if your billing system stores or processes card data directly. If you use built-in payment tools, working with PCI-compliant platforms adds a layer of protection and reduces your legal risk. It also builds customer trust. Overall, it’s better to choose a system that doesn’t just allow you to follow the rules – but helps you do it with less work and fewer risks.

Previous solutions offered no support, which posed high risks to our network in the case of a breakdown. Moreover, it limited our ability to scale the business due to shortcomings in the software’s features and integration with other solutions.

This is especially important for mid-size ISPs that don’t have large internal tech teams. Having a partner to guide setup and solve problems quickly makes a big difference. It’s also worth checking reviews before deciding. Since your billing or BSS platform is something you’ll likely use for years, choosing a provider means entering a long-term working relationship.

Monthly invoice run would take 20 hours plus. Now it takes half an hour thanks to Splynx integration with Xero, and most of things are automated in any case.

Make sure their plans match your goals. For example, if you want to launch hotspot services and offer prepaid access or vouchers, does the vendor support quick setup and flexible tools for that? Look for providers that keep improving their system after it goes live. Do they release updates regularly? Offer mobile apps? Let ISPs share feedback and vote on new features?

While every ISP has unique strategic goals, the themes above (scalability, efficiency, customer satisfaction, compliance, and reliable support) tend to be universal. Use these priorities as a lens when comparing platforms: e.g., Will Solution X help me scale without headaches? Does it improve my team’s efficiency? Will it enhance or hinder customer experience? The best choice will score well on all these fronts.

Adopting a new OSS/BSS platform is a major decision, and it’s natural for ISP owners to have concerns. But these fears are not just theoretical. They show up in real cases. Our previous article about switching and data migration breaks down the most common ones, drawn from direct provider feedback.

By raising these questions early, you can make a plan that avoids common issues. When talking to vendors, bring these points up. A good partner will be open about how they handle them. Ask things like:

How do you prevent downtime during a migration?

Can you give an example from another ISP?

What’s your usual onboarding time and process?

Is your support available 24/7 or only during business hours?

Do you offer SLAs?

Their answers will help you see if they’re ready to support you the way you need.

To fully automate billing and related tasks, you need to cover every part of the customer flow, from getting them connected to receiving payment. After more than nine years in the market, over 1,000 ISPs now run their operations with Splynx.

Below, we’ve listed some of the useful features our customers rely on every day. This checklist can help you see how Splynx supports automation and helps your business grow.

When you combine batch invoicing with Splynx’s Recurring Billing engine, you can save hours each month by automatically creating invoices for your services. Whether you bill in advance (for example, an invoice on May 1st that covers May 1–31) or after the service is used (an invoice on May 1st for April 1–30), Splynx lets you generate recurring invoices once a month on a fixed day (like the 1st or 25th), or every day using anniversary billing (based on the customer’s signup date instead of the same date for everyone). You can also charge in advance using strict prepay, where customers pay before receiving service for a set time (like one week), or bill without creating official tax documents. All of these setups can be customized per customer or for everyone.

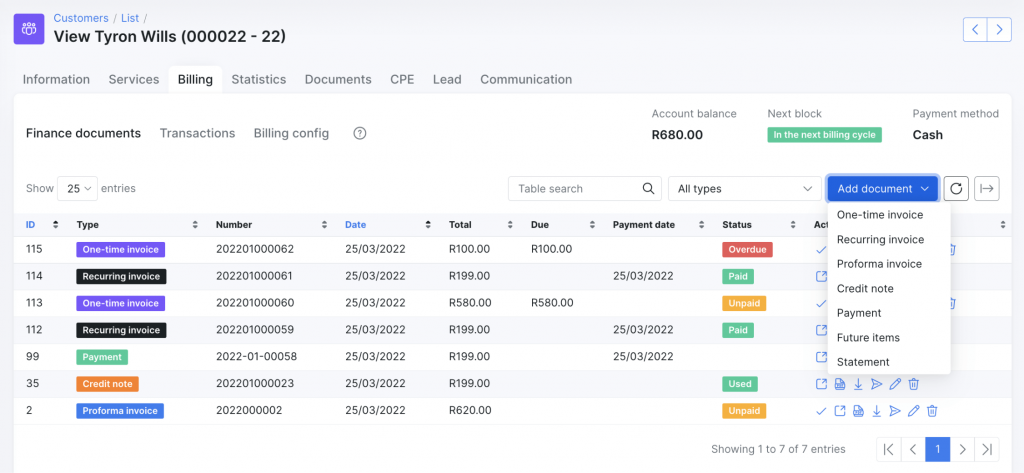

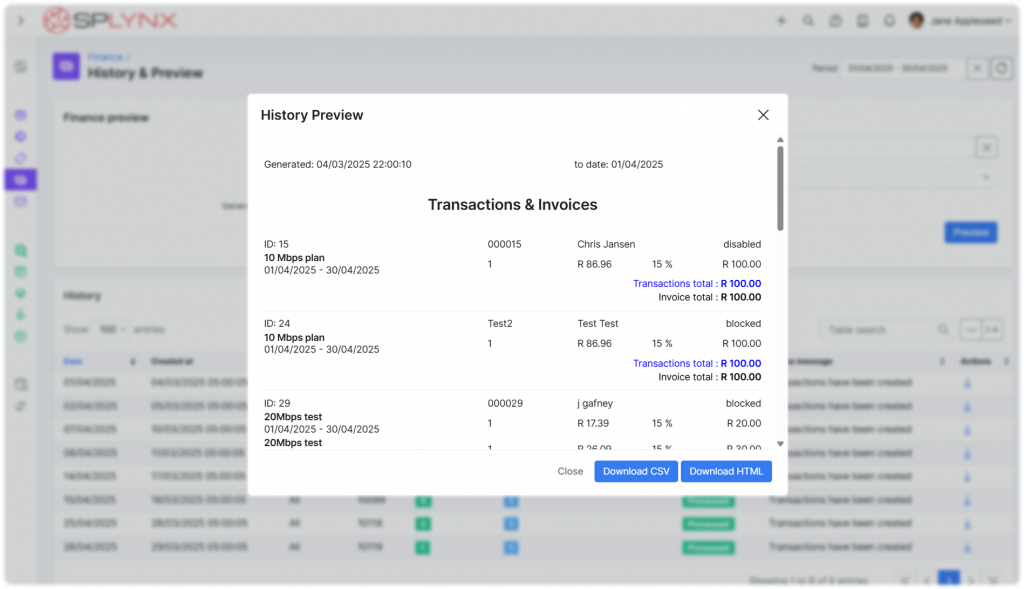

Once your recurring or prepaid invoices are generated, you can find them all in Finance → “Preview and History.” There, you’ll see each batch with the billing date, customers included, and total charges.

This section is also helpful for Mass Billing, where you can review a group of customers and their charges before sending out invoices. This works by creating proforma invoices for review before finalizing them.

When adding services throughout the day, whether for new customers, existing customers upgrading their plans, or adding additional services like static IPs or equipment, many ISPs struggle with the manual process of creating invoices after each service activation. This becomes particularly challenging during busy periods when multiple service changes occur, but invoices are forgotten or delayed until the next day, creating cash flow gaps and inconsistent billing practices.

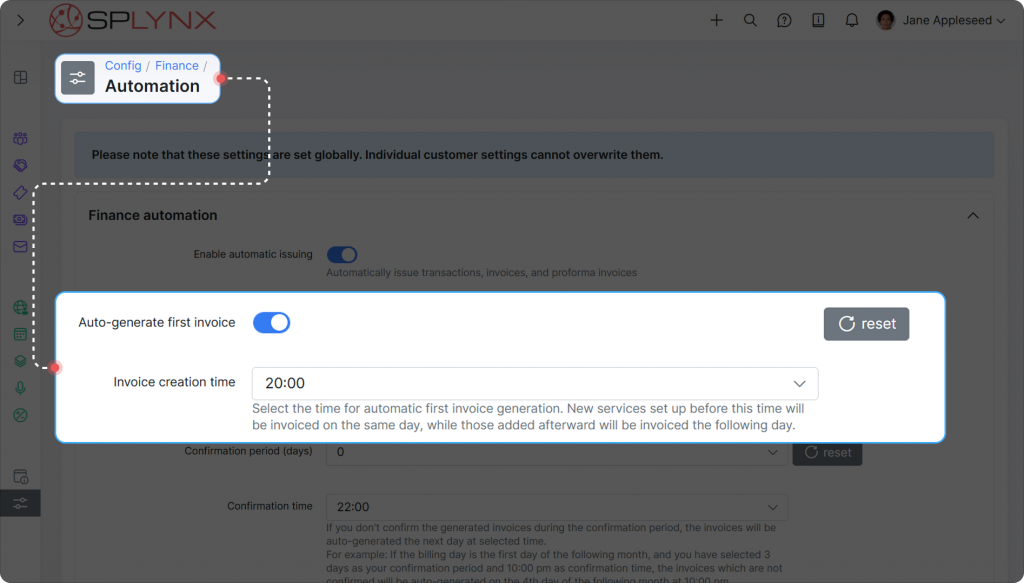

Splynx can automatically generate the first invoice when you add new services, but the key advantage is the flexibility to align timing with your specific business processes. You can set a customizable cutoff time (like 20:00) that works with your daily workflow. Services added before this time will be invoiced on the same day, while those added afterward will be invoiced the following day, giving you control over when billing occurs.

This automation eliminates manual invoice creation steps, ensures immediate revenue recognition, and maintains consistent billing regardless of workload. Your team can focus on installations and customer service while billing happens automatically in the background.

Many ISPs face delays between invoice generation and payment collection. This creates unnecessary gaps in cash flow and requires additional staff time to track payment status, which is particularly problematic when handling dozens of daily transactions across different payment methods.

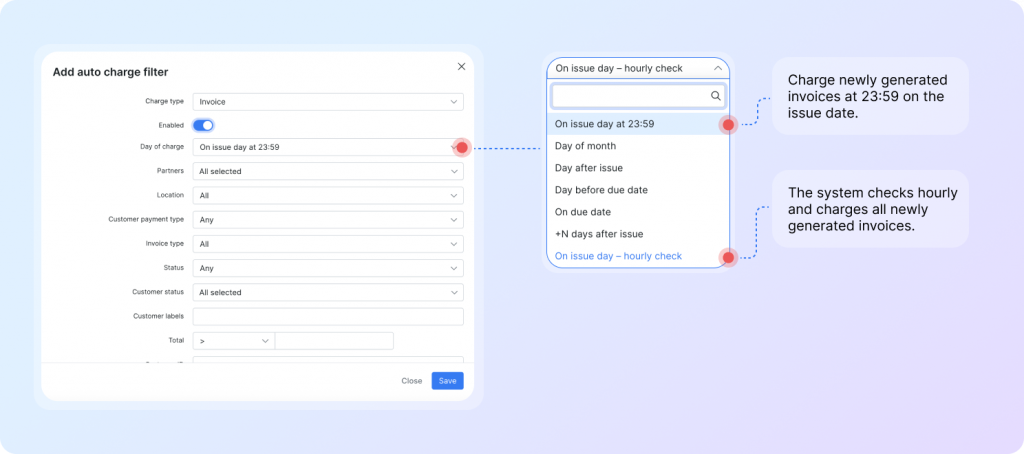

Splynx supports automatic invoice charging with flexible timing options to match your billing preferences. You can configure auto-charge filters with two flexible options: charge at 23:59 on the invoice issue date to finalize all charges at the end of the billing day, or enable hourly checks that scan and charge newly created invoices as they appear throughout the day.

This streamlines your entire billing-to-payment cycle, reduces manual payment processing, and accelerates cash flow by eliminating the waiting period between invoice creation and payment collection. Your revenue is captured immediately while maintaining full control over when and how charges are processed.

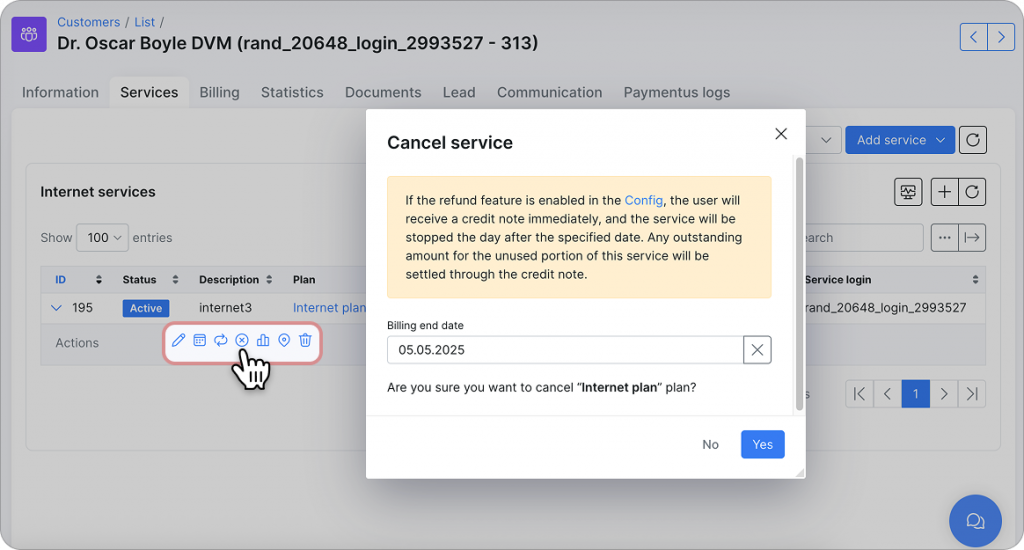

When active services need to be canceled mid-cycle, whether due to customer requests, non-payment, service issues, or administrative reasons, the traditional process involves multiple steps: stopping service for the customer, calculating unused portions, processing refunds, and correctly adjusting taxes. This multi-step workflow is very time-consuming and prone to calculation errors, especially when handling various cancellation scenarios throughout the day.

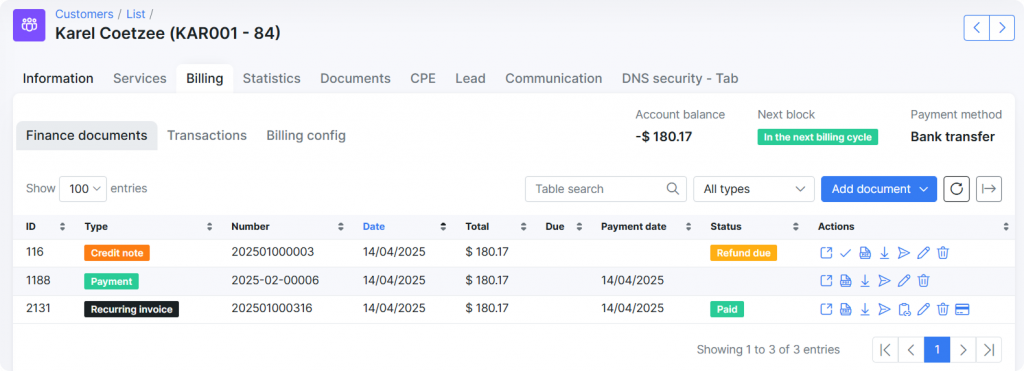

Splynx enables admins to cancel any active service directly from the Services tab with a single action (screenshot above). Simply press the cancel button, and all the rest is done automatically. When the “Refund unused money” feature is enabled in Config, Splynx instantly issues a credit note for the unused amount and stops the service on the selected date.

This eliminates the need for any involvement or administrative steps, ensuring accurate refund processing regardless of the reason for the cancellation. Admins can handle service cancellations efficiently while maintaining precise billing records and proper financial documentation.

When customers sign up mid-cycle, upgrade or downgrade their plan, or add or change a service, Pro-Rata Billing comes in to align everything with the current billing cycle. In these cases, Splynx prorates invoices automatically and makes all necessary recalculations (refund unused money, fees, discounts), so you do not need to adjust anything manually.

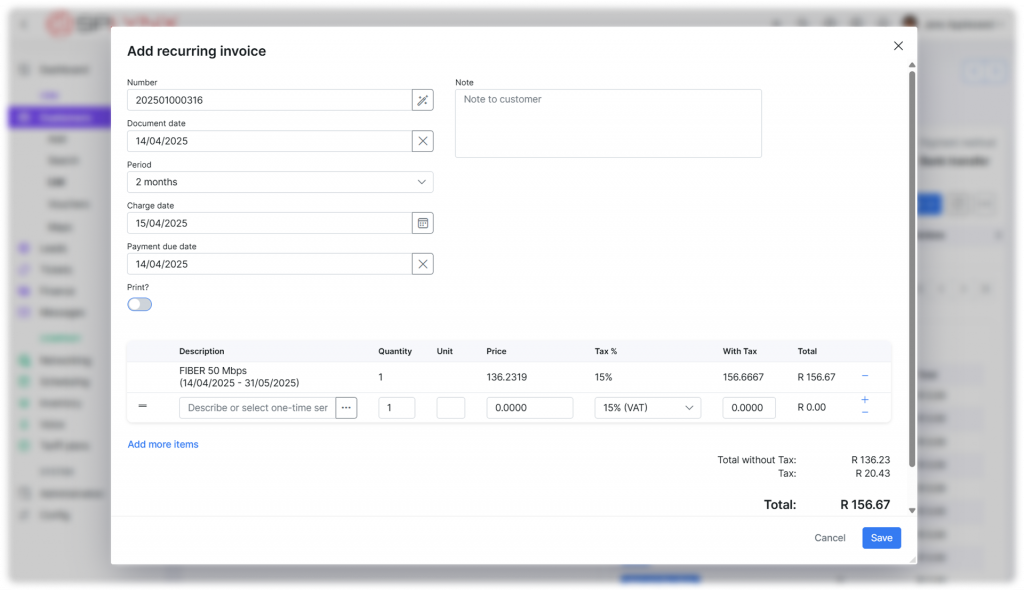

For example, your billing date is set to the 1st of the month, and a customer signed up on April 14th. You can manually (immediately) create a prorated invoice from April 14th to 30 (Finance documents/Add recurring invoice). Otherwise, the system will automatically do this on the 1st of May, including days from the previous month (14.04 – 31.05).

This logic helps you avoid revenue loss, prevent overcharging, and onboard customers at any time without breaking billing flow. All while keeping the experience smooth for both admins and end-users.

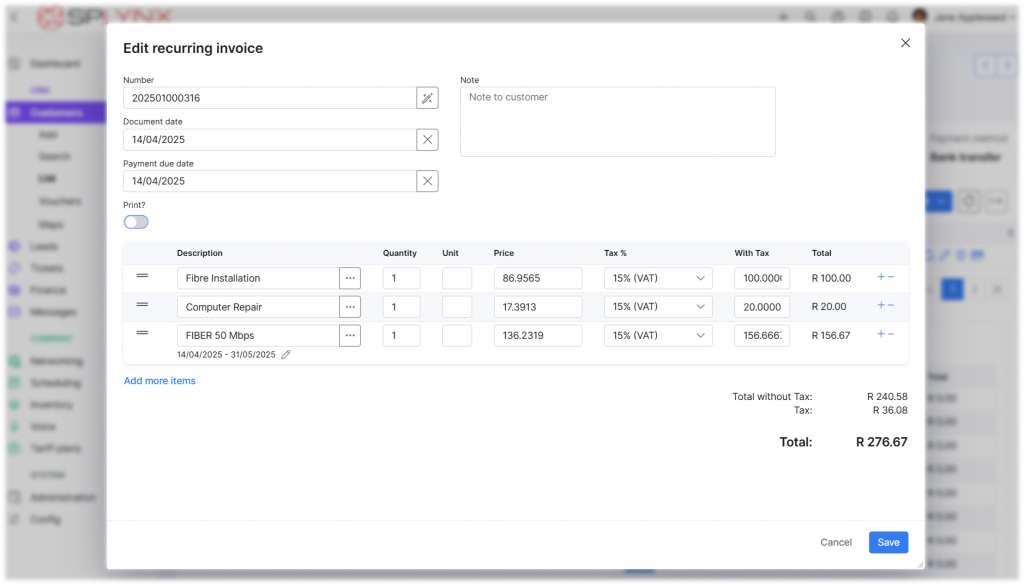

In many situations, you’ll need to charge customers for more than just their usual monthly service — for example, an installation fee, equipment fix, or other extra cost. With Splynx, all these charges can be included in a single invoice, whether added by hand or set up to happen automatically.

If you want to add something manually, just open the current recurring invoice, add a new line for the extra item, and pick it from the dropdown (like “Installation package”). Both charges will now appear on one invoice instead of two. If you’d rather automate it during service setup (like when adding internet for a new customer) there’s a quicker method. While setting up the service, you can use the “Additional one-time service” field to include the charge (e.g., “Installation $100”). Once saved, Splynx creates a “future item” that will be added to the customer’s next recurring invoice automatically. It works the same as adding it manually but saves time.

You can also use future items on their own anytime you want to include something in the next invoice. Say, a $20 repair job done mid-month. These future items don’t trigger new invoices. They’re saved internally and added to the next regular invoice — whether it’s created automatically or manually — together with the usual monthly charge.

Future items can be Debit or Credit. That means you can also use them to give discounts, refunds, or handle pricing changes, like fee adjustments when customers change plans. This keeps your billing organized: one invoice per cycle, fewer documents, and everything charged clearly and correctly.

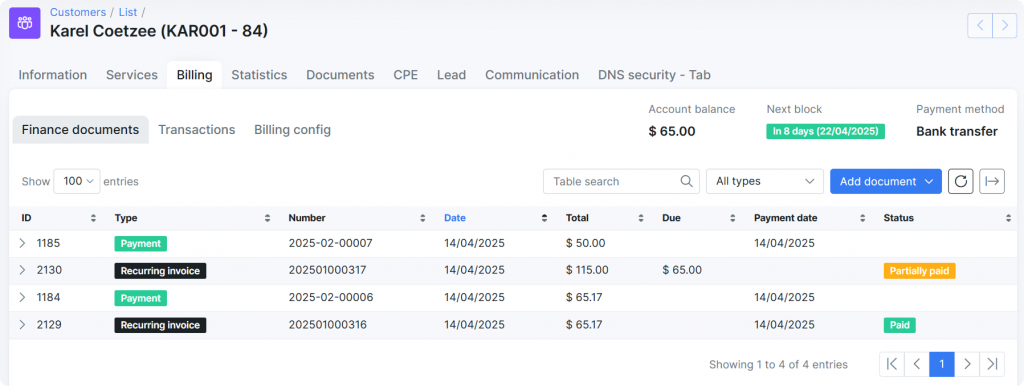

Partial and extra payments are common in ISP billing. And Splynx takes care of both without manual work, whether they come in through selected payment gateways or are added by hand.

If you’ve connected a payment gateway (like a credit card processor), payments are posted right away, no need for someone to match them manually. The same process also works for manual payments.

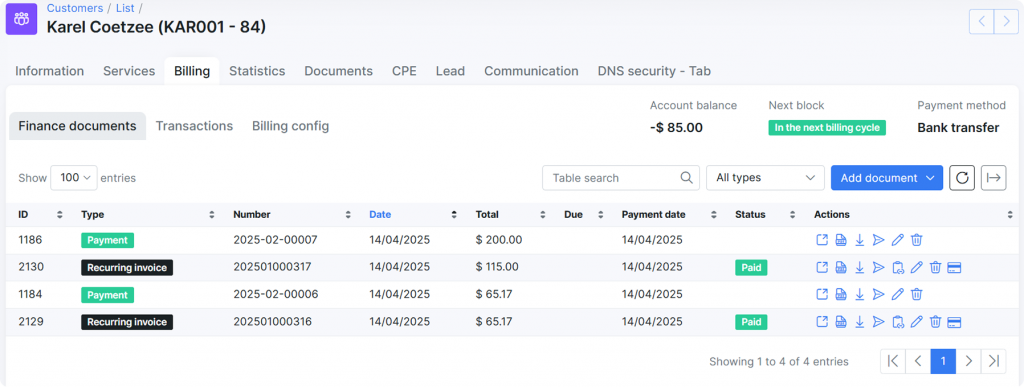

For example, if a customer gets an invoice for $115 but only pays $50, you can enter the payment manually – choose the method (like cash or bank transfer), type in the amount, and save. Splynx will then match it to the correct invoice, mark it as “Partially paid,” and show the remaining $65 as unpaid. Once the rest is paid, the system updates the invoice to “Paid” and brings the customer back online if access has been paused.

Overpayments are handled the same way. If the customer pays $200 on a $115 invoice, Splynx marks it as “Paid” and stores the extra $85 as account credit. That credit will be used automatically on the next invoice to lower the total due.

Your finance team doesn’t need to do anything extra – Splynx sorts it all out, whether the customer pays the exact amount, less, or more.

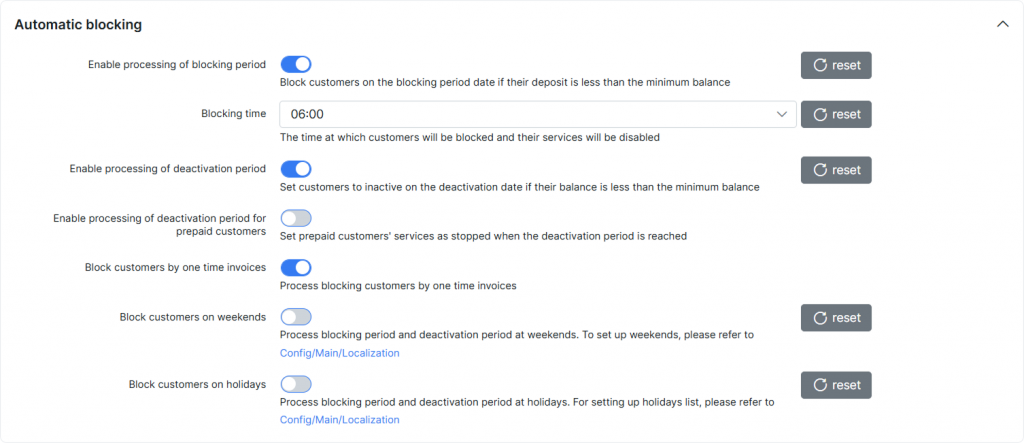

Blocking non-paying customers automatically and reactivating their accounts after paying debts is a rock-solid base for modern ISP billing and delinquency management. It ensures that customers either pay or lose access – and that your network isn’t used for free. In Splynx, this functionality is built into the billing engine and works fully automatically based on your configuration, both for recurring and prepaid billing.

Blocking rules can be defined globally across your instance or customized per customer. For example, you can use anniversary billing, with payment due 10 days after the invoice issue and automatic blocking on the 11th. Then, if the customer still doesn’t pay, deactivation can follow, which means all services are stopped and the account is marked inactive. You can update settings anytime with one click (for selected partners or billing types).

Blocking can happen at specific times (e.g., midnight or 6 AM), and you can exclude weekends and public holidays to avoid service interruptions during non-working hours. You can adjust the behavior to match your business needs. Admins can also block or unblock customers manually at any time if needed.

When a customer is blocked, Splynx either disables access or redirects them to a custom page – typically one that explains the situation and allows them to pay. As soon as the system detects that a recurring invoice is fully paid or the balance is topped up on the same day as deactivation (for prepaid billing), access is restored automatically. There’s no need for staff intervention.

Not so long ago, techCONNECT was stuck in a manual mess (you can read their full story). They had to cut off customers who didn’t pay manually, which got crazier as more people signed up.

Collecting and reconciling payments manually doesn’t work well as your business grows. It takes too much time and effort. With Splynx, you can automatically charge customers when an invoice is created – as long as they have a saved credit card.

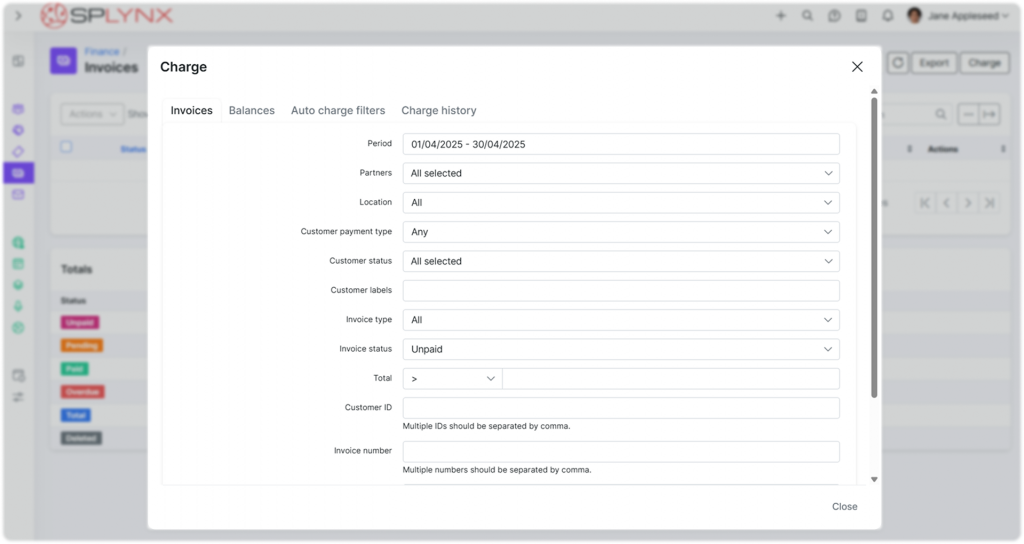

This works using Auto charge filters, which are linked to payment gateways like Stripe, NetCash, and others (Splynx supports more than 15 systems, including PayPal, Stripe, Authorize.net, and IPPay, with more being added regularly). These filters let you set rules for when and how charges are made. You can fine-tune them based on:

Once a filter is set, Splynx runs the process automatically at the scheduled time and charges all matching invoices. You can see all results — successful or failed – in the Charge history.

If you need to process a payment manually, just go to Finance → Invoices, pick the unpaid ones, select the payment method (e.g., Stripe), and click Charge. This setup gives you full control – automate as much as you want, and step in manually when needed.

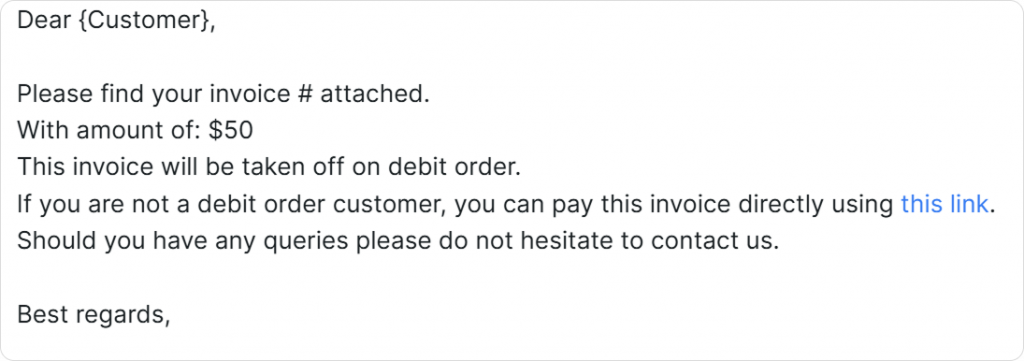

Getting paid on time isn’t just about sending invoices or offering local payment options. Communication plays a big role, too. In Splynx, there are two tools that help: Notifications and Reminders. Notifications are triggered by billing actions (like when an invoice is created, a payment is made, or a customer gets blocked), while Reminders are sent only when invoices stay unpaid. Together, they help keep customers informed and encourage faster payments.

You decide how and when these messages go out – by email or SMS, with attachments, and using your own message templates. You can also set delays (e.g., send 3 hours later), skip weekends, or limit messages to business hours. There are even notifications for things like expiring credit cards, service bundles, or contracts.

Reminders work if a bill hasn’t been paid. You can set up to three steps with different delays. For example, reminders after 3, 5, and 7 days. To help customers pay faster and avoid extra fees, reminders clearly show how much is due and include a direct payment link. If a card is saved, payment takes one click. If not, the customer can enter details and save them for next time.

Sometimes, you need to cancel or change a charge. For example, if a customer is unhappy with the service or you agree to give a discount after the invoice has already been sent. In Splynx, this is handled with credit notes. Instead of removing the invoice, which could mess up your records, you create a credit note to balance it out. This is useful in cases like:

When a credit note is created, it adjusts the customer’s balance and is recorded with a status:

This makes it easier to keep things clear for your customers and maintain an accurate billing history without removing financial documents.

If a customer changes to a cheaper plan in the middle of the month, Splynx automatically calculates the unused amount and creates a credit note. Some or all of it is then used for the new plan, and if any money is left, it stays on the customer’s account to be used later – either on their next invoice or for a one-time charge. You can also issue a refund straight from the credit note with one click, or by adding a negative payment manually.

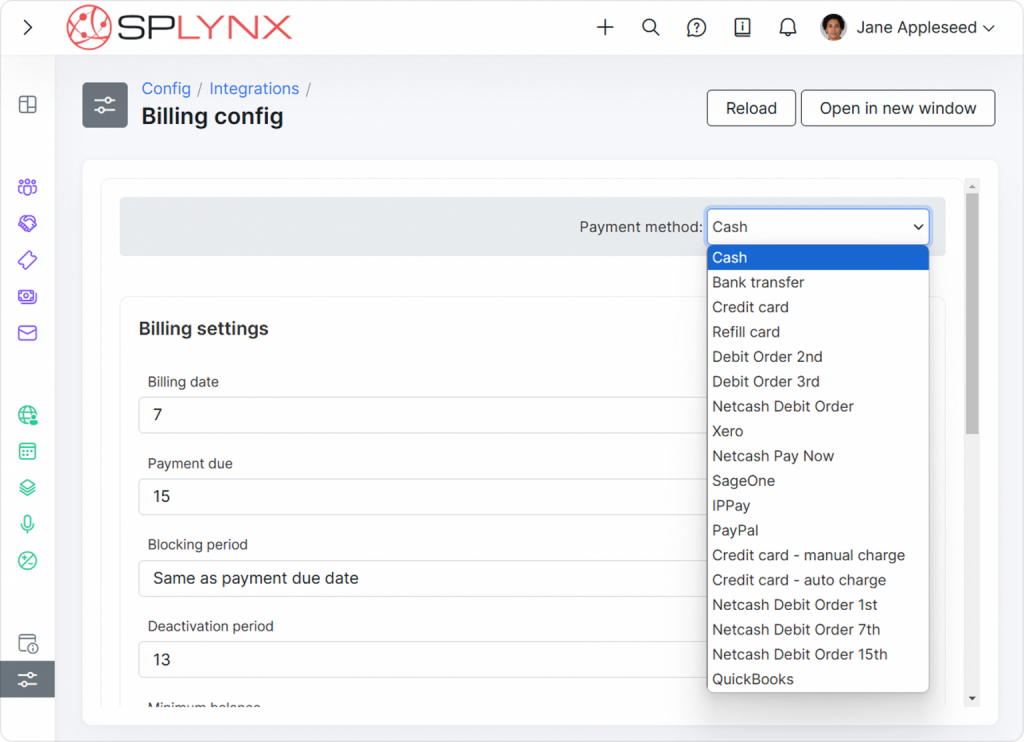

Handling different billing setups for each payment method can quickly become confusing – especially when customers switch between paying by cash, card, debit order, or bank transfer. Splynx makes it easy by letting admins change a customer’s payment method right away and automatically apply the right billing settings based on pre-configured rules.

Instead of updating billing dates, due dates, blocking period, and other settings manually every time a customer changes how they pay, you can set up rules once for each payment method. After that, Splynx will apply the correct settings automatically whenever a customer uses that method – either one by one or in bulk.

This is particularly helpful for providers who run several debit batches each month or let customers pick different billing dates. Reminders that are based on billing schedules also adjust automatically to follow the new settings.

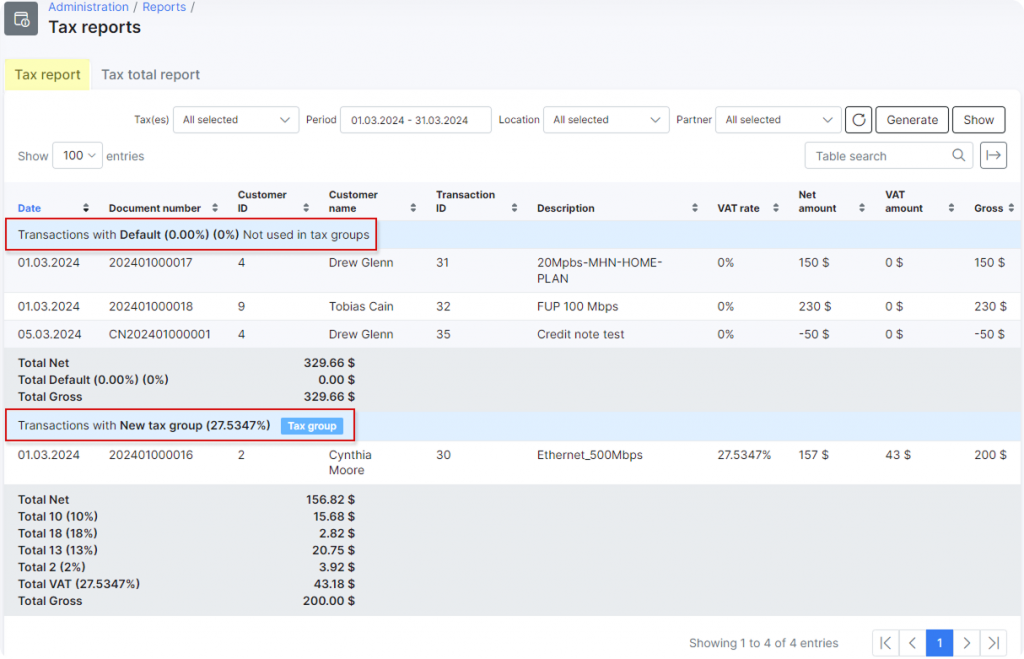

Taxes are something every ISP has to deal with, and trying to do it manually doesn’t work well at scale. Splynx has a built-in custom tax management solution that helps you apply the right taxes during billing automatically. This helps reduce mistakes, saves time, and keeps you aligned with local tax rules.

Instead of adjusting tax rates manually on each invoice, you can set up rules ahead of time:

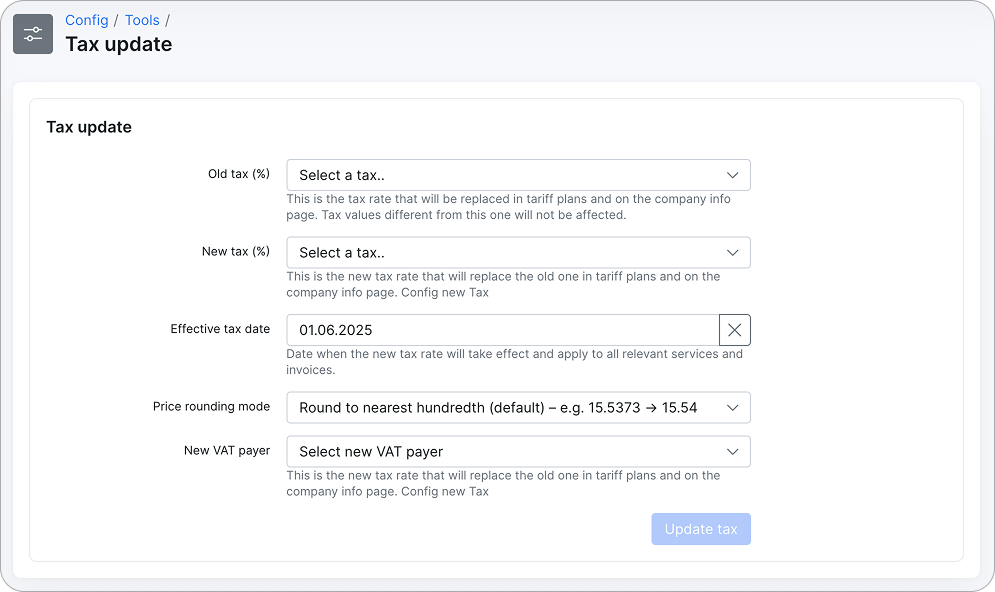

Very often, tax regulations can change unexpectedly, and when local governments adjust tax rates, ISPs need a quick and reliable way to update billing calculations without disrupting ongoing operations. Tax Update feature is exactly what you need for such cases. It automates mass tax changes on specified due dates, enabling administrators to apply a new rate system-wide as required. Once updated, the new tax rates will be used on the selected date across all relevant billing operations, ensuring consistency and compliance with tax regulations.

All tax details are collected in Tax Reports, which can be sorted by time period, partner, location, or tax type. You can also export the data in the format you need for accounting or audits.

Of course, billing doesn’t stop with sending invoices. Accounting is a key part of the full process. Whether you use NetSuite, Xero, Sage, QuickBooks, Holded, or Zoho Books, Splynx helps you pass billing data to your accounting system with no extra work.

Depending on the size of your business and the tools your finance team uses, we offer two options. You can either sync every invoice, item, and payment for each customer – pushing every transaction to your accounting platform in detail – or simply send only totals of certain data (like total income or invoice amounts), which is helpful if your platform has limits on how many records it can handle.

To get started, you’ll need to set up transaction categories in Splynx and link them to the matching categories in your accounting platform. This ensures each invoice or payment is properly grouped and reported on the accounting side – whether it’s individual customer billing or bulk totals per plan. This is a manual process that is done once during the initial setup.

Splynx keeps track of what’s been synced in separate tables for invoices, credit notes, and payments. If anything changes later, the system can re-sync updated items automatically to keep everything in sync between platforms.

If you also sell or rent equipment, Splynx can connect inventory items with your accounting software. This way, hardware sales or setup fees are assigned to the right codes, and all records stay clear and organized.

Whether you need to sync every transaction or just journal totals, Splynx can match your accounting process – saving your team time and reducing the chance of errors.

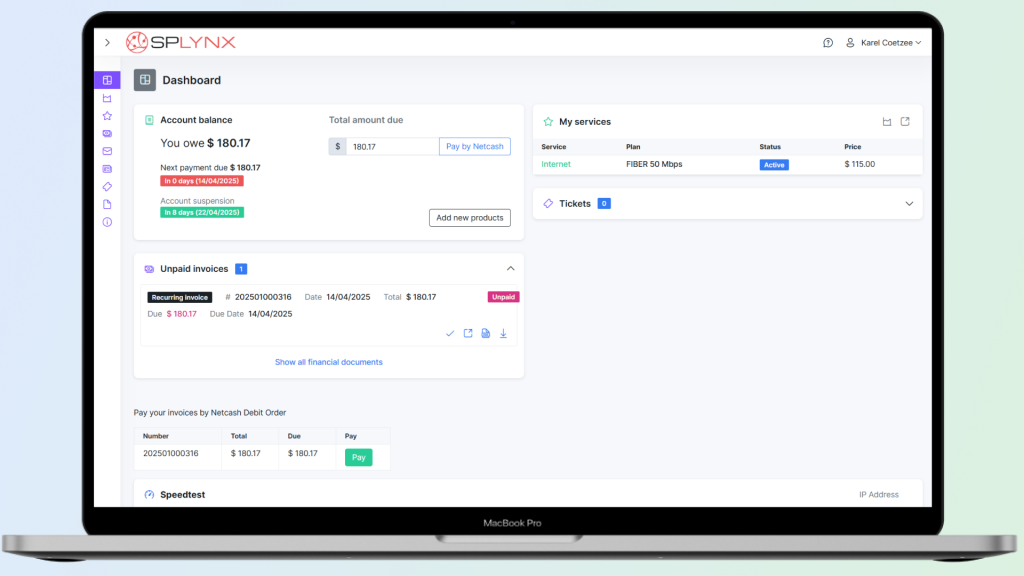

More and more users prefer to solve simple issues on their own instead of reaching out to support – especially for things like invoices, plans, or account updates. Because of this, giving customers access to self-service tools is now expected. Splynx offers a customer portal where users can:

The portal works on any device, and there is also a mobile app with full functionality. Customers can log in with a username and password or use social login options like Gmail or Facebook. They can see all their financial details, including unpaid invoices, credit notes, and billing history.

If allowed by your setup, customers can also change their plans themselves – either right away or on a future date. Splynx takes care of the billing updates automatically, adjusting the charges or credits based on what’s left in the month.

You can also customize the portal’s look and feel to match your brand, from the login screen to the app icon.

Find out how Splynx helps ISPs grow

Learn more